Australia and New Zealand

Open Banking Ecosystem Map and Report

September 2025

Proudly supported by

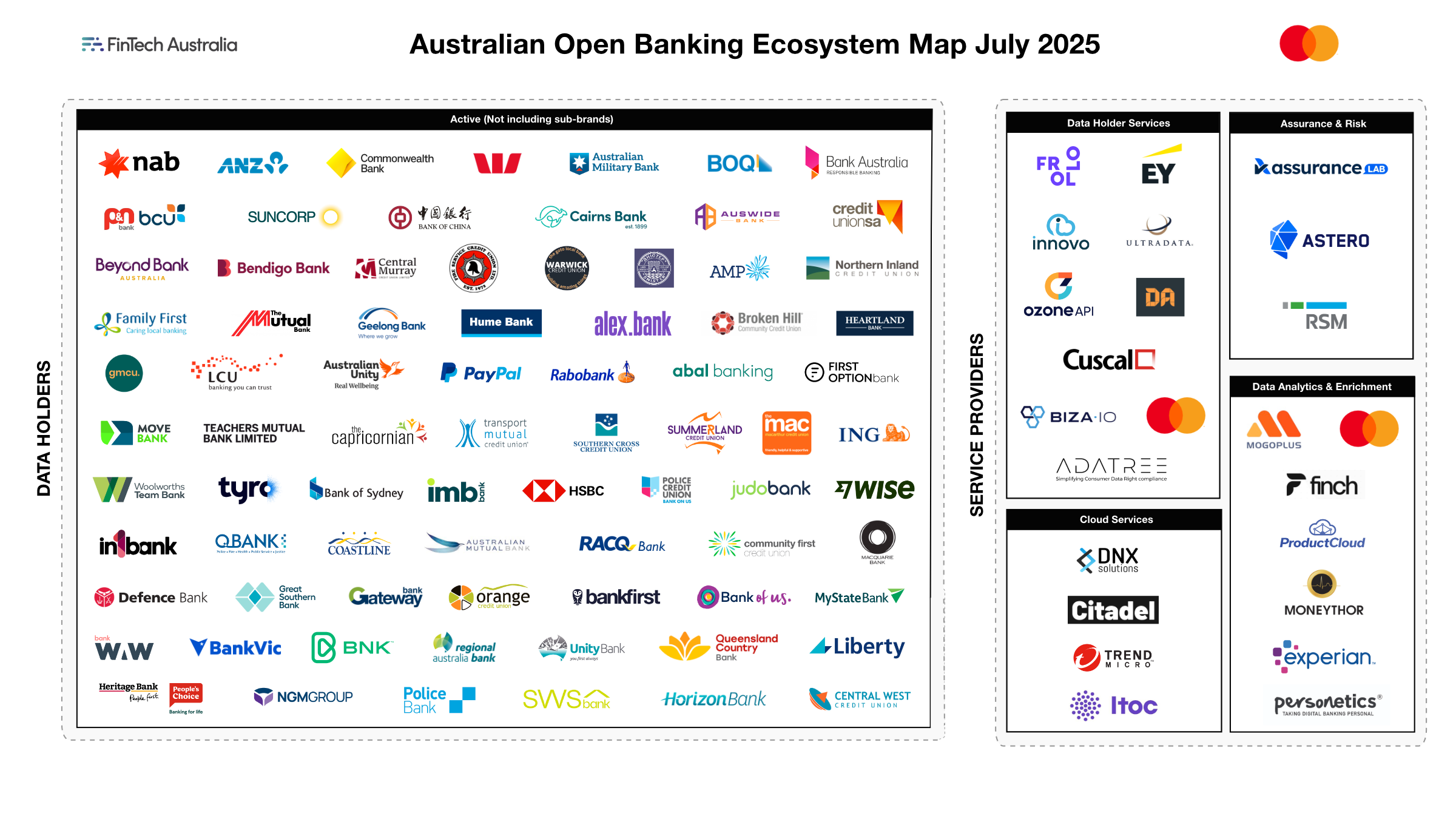

Quick CDR Facts

at July 2025

530,000

200

Registered Software Products

Consumer Bank Account Coverage

Accredited Data Recipients & Other Access Models

CDR users in H1 2024

99.74%

190

5.4m

active consumers and businesses in 2030

Our bold 2030 vision

This report sets out a vision for the CDR in 2030 for consumer uptake, and outlines some of the waypoints on the roadmap for how we can get there. At its heart of this vision is a bold goal: to have a target of 5.4 million Australian consumers and businesses using and benefiting from the CDR by 2030, whether that’s managing daily budgets, comparing financial products, or applying for loans.

— Dr Bill Roberts, Fellow at the University of Cambridge Judge Business School Centre for Alternative Finance

“I am excited and encouraged by the ambition of this ecosystem report in setting some big five-year goals for the future of Open Banking and open finance in Australia. I truly believe in the value that Open Banking can bring to economies and that if the ecosystem fixes the known challenges then the CDR will be a great success.”

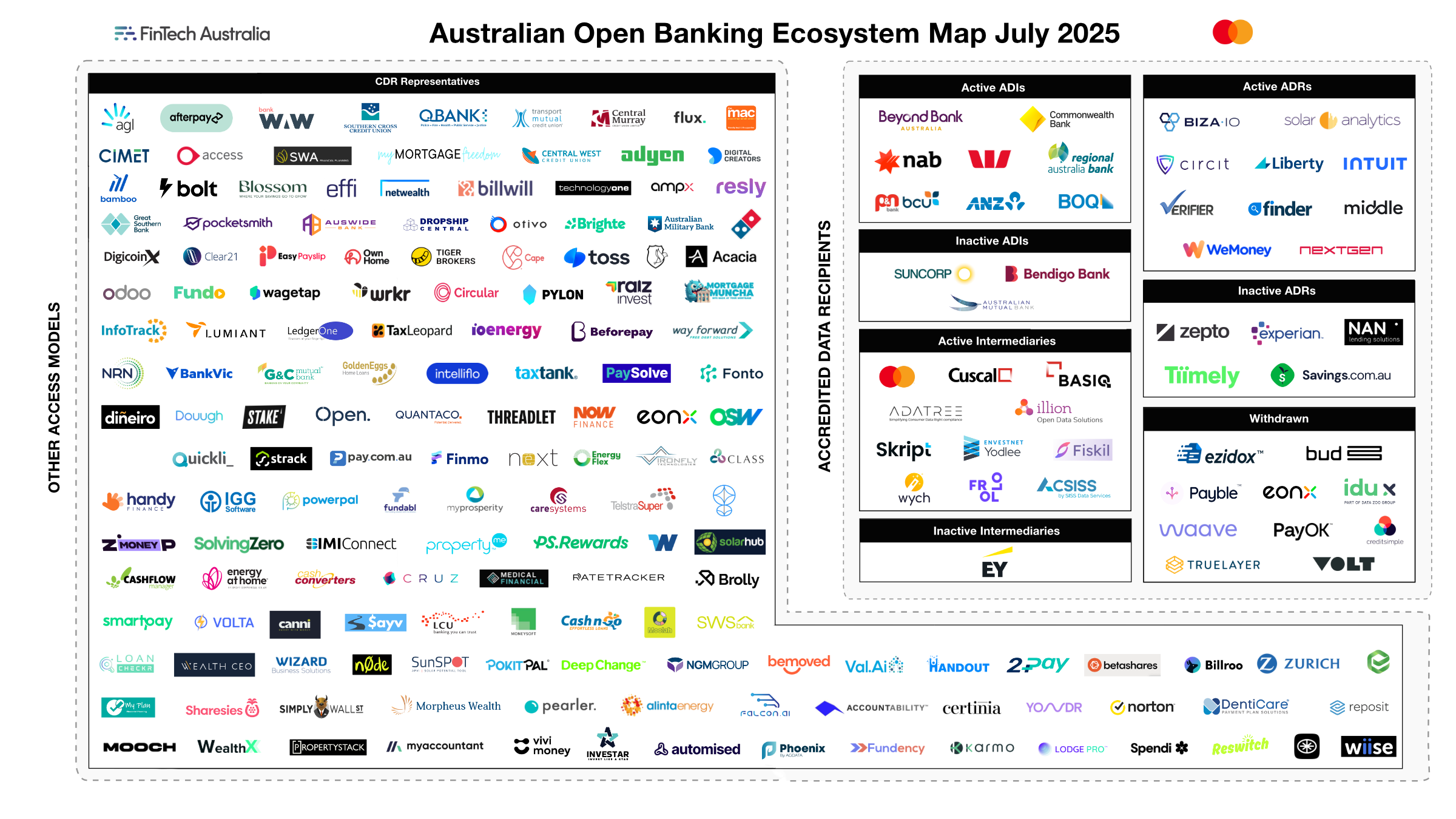

Consumers are using the CDR

More than half of Accredited Data Recipients (70%) now use Outsourced Service Providers (OSPs), with a 100% increase over the last 15 months. This increase is in line with predictions in our last report and comes off the back of recent changes to allow Representatives to use OSPs.

3-4%

CDR penetration as at H1 2025

— Rehan D’Almeida, CEO, FinTech Australia

“This report is both a reflection of how far we've come and, crucially, a blueprint for how far we can go. Open banking boosts productivity, reduces consumer costs, and underpins a safer, more competitive digital economy With the right policy settings and support, it can deliver immense value”

The productivity dividend

The productivity benefits that flow from allowing consumers to easily share their data are well understood. The Productivity Commission has estimated that a mature data-sharing regime could add up to $10 billion to Australia’s annual economy. This accords with findings made by McKinsey that countries who adopt open financial data ecosystems could see GDP increases of up to 1-5% through productivity and efficiency gains from improved workforce allocation, enhanced credit risk evaluation, streamlined access to services and a reduction in fraud-related losses.

$10bn

productivity benefits for the Australian economy

— Brenton Charnley, Head of Open Finance Australasia, Mastercard

“The CDR is a critical part of Australia’s digital infrastructure, giving consumers a safe and secure way to share their data and access better products and services. It has taken significant effort to get to this point, and Australia’s open banking regime is now world leading. With uptake growing, the right policy settings to remove barriers to participation will allow the CDR to drive productivity, ease cost-of-living pressures, fuel innovation and build greater trust in the digital economy.”

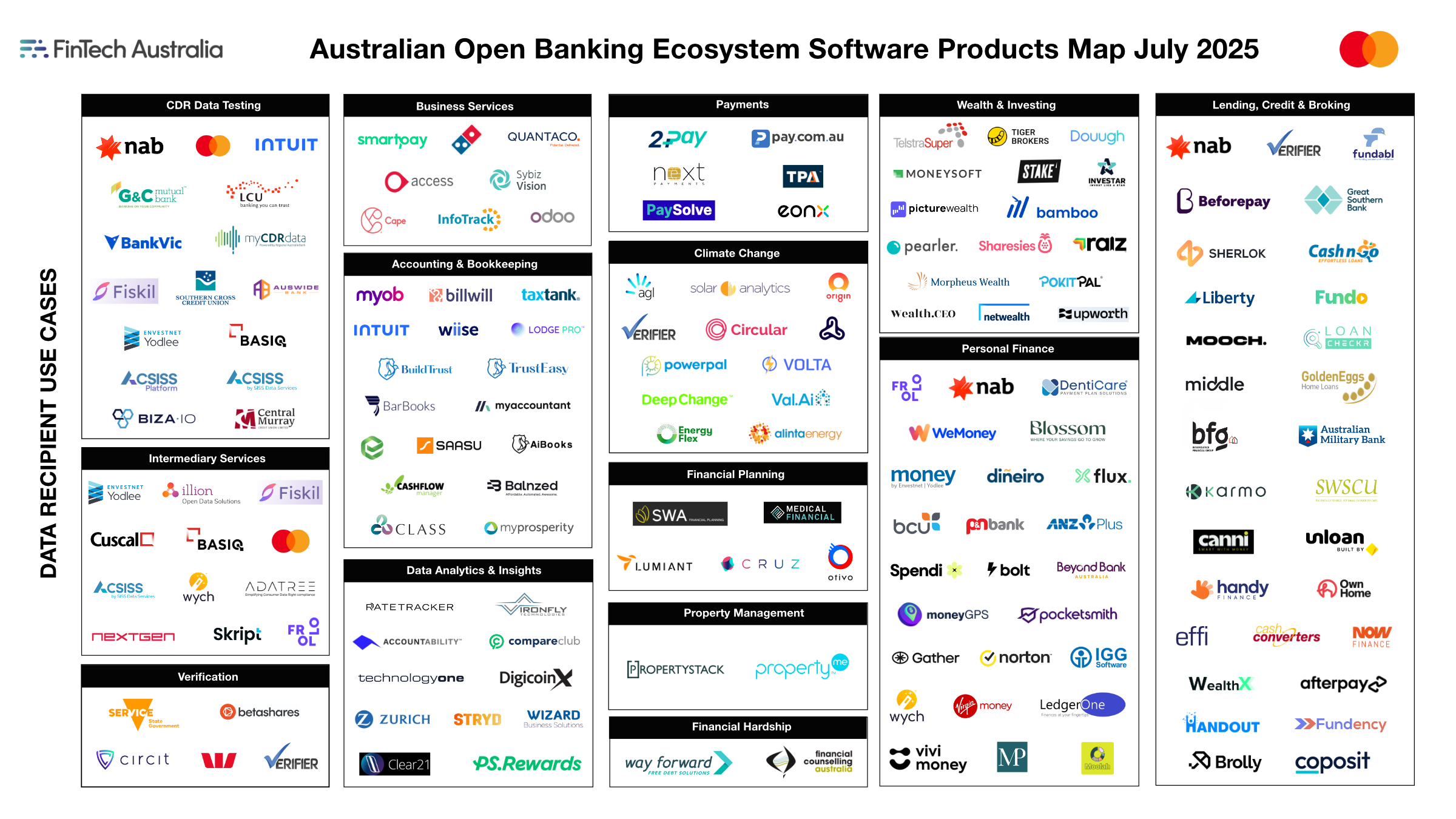

Download the Australian Open Banking Ecosystem Map and Report

September 2025

If you want to understand who is participating in the Australian Open Banking Ecosystem and the latest trends, download the comprehensive ecosystem map and report.

Looking to get added to the Ecosystem Map?

Whilst we endeavour to collect information on all participants during our research, we might miss participants from time to time. If you would like to request an addition or amendment to the Australian Open Banking Ecosystem Map please fill out the form below.